Hospitals and clinics warn of serious crisis in the health system due to billion-dollar debts

[ad_1]

In a letter sent to the Minister of Health and Social Protection, Guillermo Jaramillothe Colombian Association of Hospitals and Clinics (Achc)a union of institutions providing public and private health services, announced the concern it has for the difficulties in the flow of resourcesthe increase in the portfolio, the high delinquency rate and the impact generated by the liquidation processes of the health promoting entities (EPS), among other situations that affect the fulfillment of the obligations of the health providing institutes (IPS).

In accordance with this, the Minister of Health was presented with the need for the settlements of the EPS that are currently being carried out and those that could come to be accompanied by measures that protect the hospital network. To do this, they hope that the creation of the guarantee fund promoted by the union, which would counteract the effects of settlements between health service providers.

Now you can follow us on our WhatsApp Channel and in Google news.

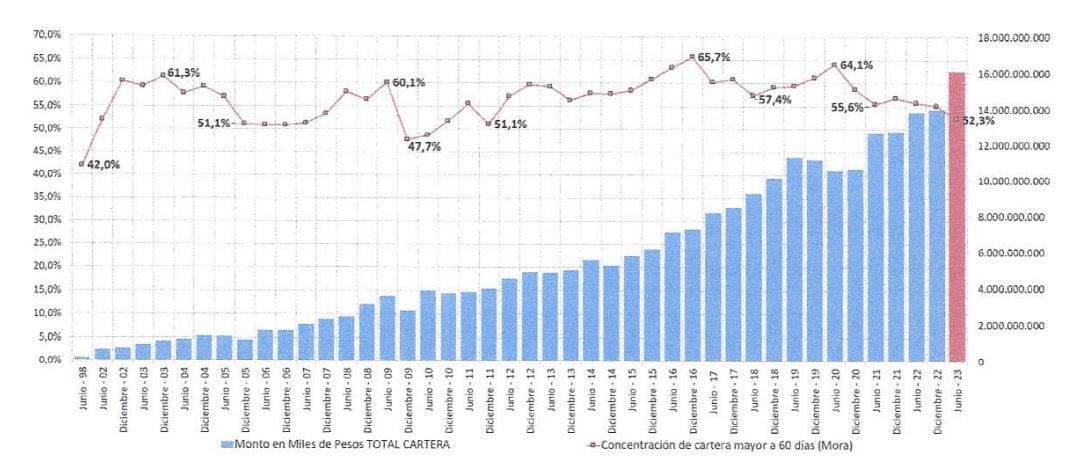

The hospitals and clinics affiliated with the Achc gave Minister Jaramillo a report on the debts with the lending sector. The amount of the portfolio, far from improving, increases and the maturity percentage remains at high percentages. According to the portfolio study with a cut-off date of June 2023, for 207 institutions it shows an increase of 14.7%, compared to the cut-off date of December 2022. A growing absolute figure of more than $16 billion in front of the $14 billion to December 2022.

“Delinquency does not behave better. In the portfolio concentration of 60 days and more as of June 2023, the State has 65.6%, the EPS of the subsidized regime 60.8%, the EPS of the contributory regime with 51.9%for an average total in the study of 52.3%,” indicated the union.

He stated that the previous situation is getting worse with increasingly frequent behaviors such as delays in EPS authorizationsdecrease in agreed transfers, delay or no reconciliation and purification of the portfolio, pre-audit requirements, pre-authorizations, administrative procedures that prevent the filing of invoices and lack of legalization of advances drawn by these entities.

Given the situation, the Achc made several proposals:

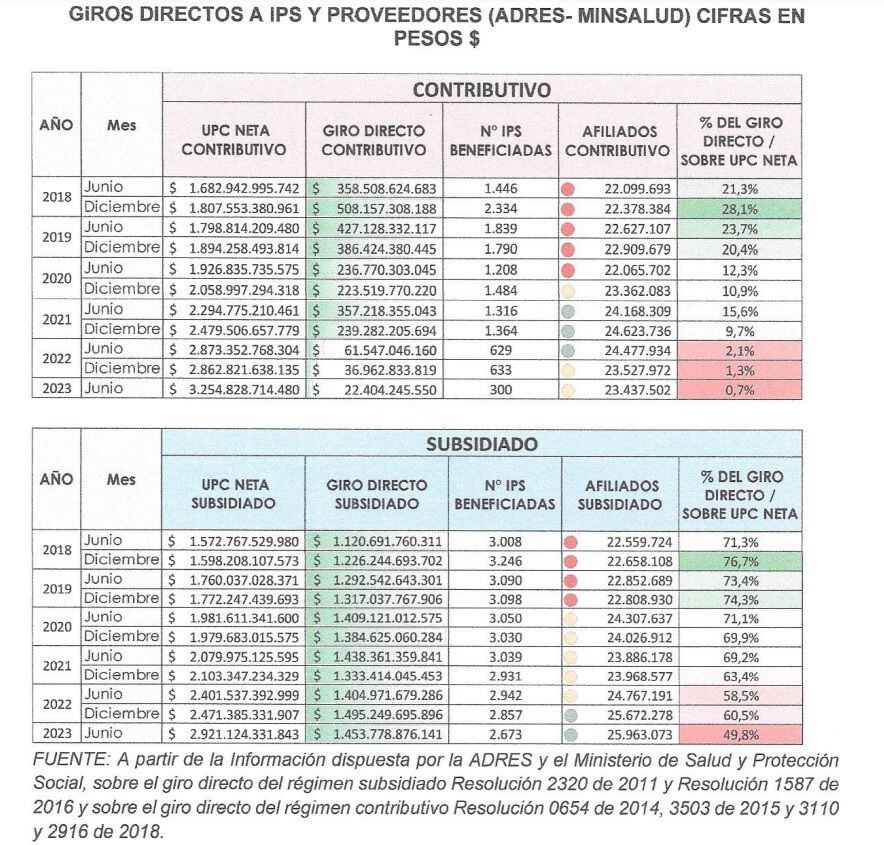

- The urgent and full application of the universal direct transfer. That all EPSs be included with some type of measure or intervention by the National Health Superintendence and transfers are made in sufficient percentages to irrigate resources towards the IPS. In the subsidized regime, transfers are moving away from the established minimum percentage of 80% and in the contributory regime, amounts and numbers of IPS have plummeted. In 2018 they were $358,000 million per month among 1,446 IPS and by 2023 it dropped to $22,000 million for 300 IPS; less than 1% of the total net capitation payment unit (UPC).

- Divest the technical reserves of the EPS which, according to Supersalud in its financial statements as of June 2023, have an amount close to the $8 billion and they are supported by investments Approximate $5.3 billion. These resources would inject liquidity into the hospital network.

- Expand the rediscount quota with a compensated credit rate authorized to the Territorial Development Financial (Findeter) under the line “Liquidity health commitment”, which could irrigate working capital resources or replace debts to the IPS. Request to public banks, assume leadership and promote better access conditions in this line.

- Allocation of resources for purchase of portfolio from the IPS and that additional mechanisms be explored for payment of the obligations acquired by the EPS.

- Review and optimization of times for collection of care with Mandatory Traffic Accident Insurance (Soat). Currently, the certificate of exhaustion of coverage that insurers must issue takes months, glosses are formulated on the invoices and to clarify them they grant appointments that go until February and March 2024 and until they clarify the accounts, they do not issue said certificate, without the which is not possible to settle in the Administrator of the Resources of the General Health Social Security System (Adres). That requirement must be modified.

- That the destiny of 0.5 points of social VAT to the health systemauthorized in a past tax reform, can specifically direct its use to the liquidity of the health service provider system.

The union concluded by noting that it considers that adopting the proposed measures, integrated into a simultaneous and immediate liquidity plan, can help the lending system to continue guaranteeing the complete, timely and adequate assistance to all members of the system.

[ad_2]